Hi, I'm olivia

Creative, entrepreneur, mother, speaker. I thrive on learning, growing and sharing my journey in the hopes to inspire others to live independently, confidently and courageously.

Categories

finance

home & LIFE

business

travel

confidence

freebies for

dream makers

Being in control of your finances gives you more freedom to do more of the things you want to do it your life. That's why I have created a bunch of free resources to help you to get in control and live a life on your terms!

grab the freebies

Hi, I'm olivia

about olivia

How To Set A Budget + FREE SPREADSHEET

April 11, 2019

So I know this has been promised for a long time now. But FINALLY, I got my self organised and have put together a family specific Budgeting Spreadsheet for you to download and use!

Here you should find everything you need to list in order to work out what your monthly spending looks like. The goal is that this can help you work out where you might be able to trim down and where you can potentially save more!

A few tips to set your budget…

- I suggest going into your online banking and downloading the last three months of your spending. From both accounts and credit cards if you have them. From there I would create an average spend on things like utilities to pop into your budget.

- Make things as easy as possible on yourself when gathering all your information. If you don’t already have access to your accounts online, then set this up. Things like Centrelink, superannuation, electricity, gas, water, phone, internet or even your Netflix account or insurances. Almost everything you should be able to get access to online and have your statements or reference to current payments and rates so you can fill this into your budget. CLICK HERE FOR MY PASSWORD TRACKER.

- Sit down, with your partner if you have one, and have a look at what you’re really spending each month. Are there payments coming out you knew nothing about or perhaps thought you cancelled? Deal with this ASAP!! Spending $100’s on lunches? Maybe put a plan in place to reduce this?

- Once you’ve filled out all the details, keep it updated every month and work out accurately what is being spent! Work out what you could potentially be saving by subtracting your spend from your income (the spreadsheet does this automatically for you) and take note that this is what you could be saving. This is a huge motivator to save that or more each month!

- If you are spending more than you earn, well then to put it simply, you’re kind of fucked, right? If you want to save, or at least get yourself out of debt you need to be spending less than you make, it’s simple, right? At least by working out your budget on this sheet, you can see exactly what you’re making, spending and potentially where you can reduce your spend.

So let’s get this bad boy downloaded and start saving that money!!

How to download and use your spreadsheet?

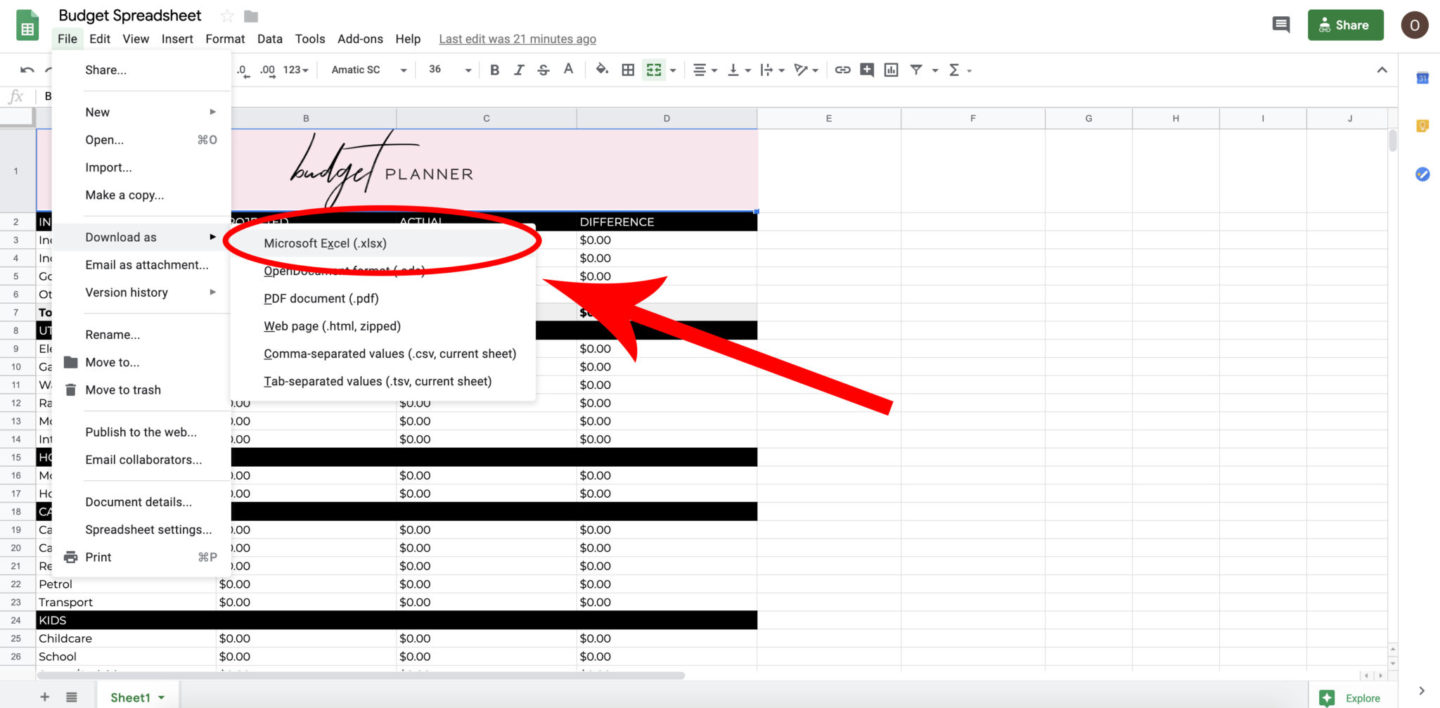

Here is a quick guide on how to use the spreadsheet. I’ve created it in Google Sheets as I know not everyone has Excel but you can convert it to an Excel Spreadsheet if you would like.

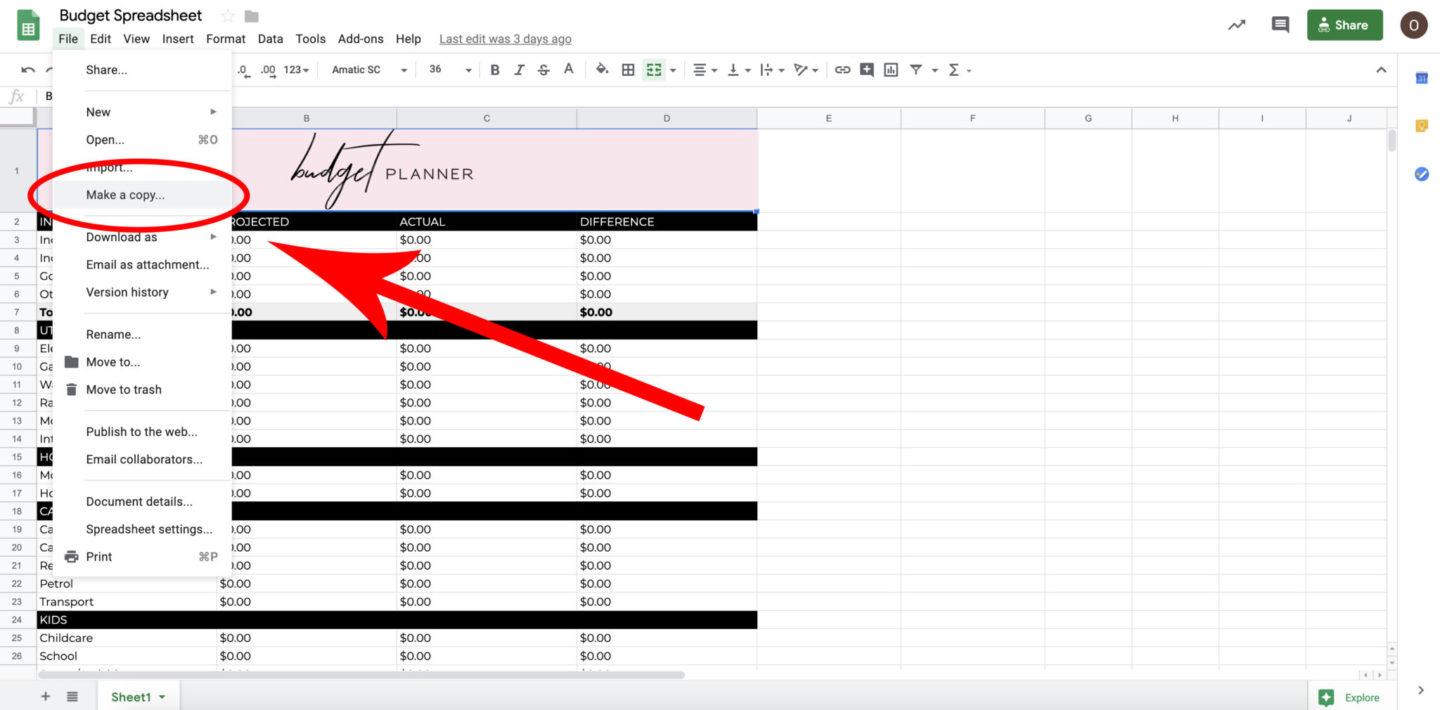

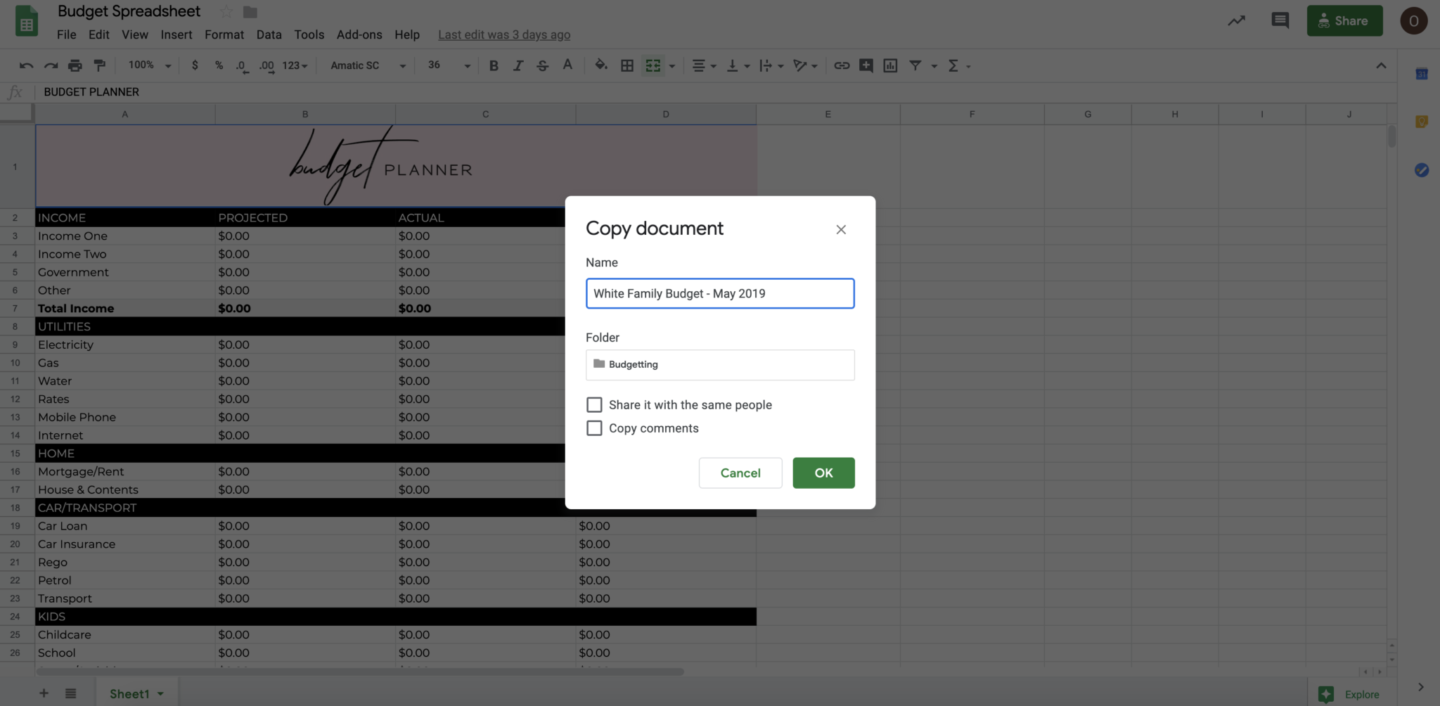

- Once you’ve opened the file, you need to go to “File” and “Make A Copy”. From there you can rename the file, I suggest noting the month and keeping it monthly. If your super savvy then create new tabs on the same sheet each month and duplicate it to a new tab each month.

- If you want it as an Excel document, you can choose to “Download As” and select “Excel Document” (outlined below). The formulas will still work but you may lose some formatting.

- Enter in your incomes first and get your income total. If one of these is blank, you still need to enter $0 for the formulas to work.

- Every field needs to have a dollar value, even if it’s $0, to work. If you’re getting an error, check the rows and columns all have this input.

- Once you have filled out all the relevant fields, go back at the end of the month and fill in your actual costs. This will give you exactly what you should have spent/saved and also works as a template for the following month to amend any incorrect costs.

I suggest scheduling in around 30 minutes to an hour each month. Perhaps a Thursday night, grab a wine, get the kids to bed and sit down together and go through everything and fill it out in the sheet.

For those after the manual printable of the spreadsheet, find it here!

Talking about where you can potentially save some money, I have some great blogs with ideas on meal planning, making extra side hustle money and decluttering that can save you heaps here:

7 Ways To Save Money Without Spending Any Less

top reads

top reads

getting chatty with it

Olivia has been a keynote speaker and panellist at several national and international conferences and events over the years. Find out more about speaking opportunities with Liv.

Inspiring and motivating us to live unapologetically and confidently ourselves.

speaking

get on the list and stay in the know!

Be in the know, hear about latest products, get access to discount codes and latest from the blog.