Hi, I'm olivia

Creative, entrepreneur, mother, speaker. I thrive on learning, growing and sharing my journey in the hopes to inspire others to live independently, confidently and courageously.

Categories

finance

home & LIFE

business

travel

confidence

freebies for

dream makers

Being in control of your finances gives you more freedom to do more of the things you want to do it your life. That's why I have created a bunch of free resources to help you to get in control and live a life on your terms!

grab the freebies

Hi, I'm olivia

about olivia

How To Set Your Mind To ‘Money Saving’ Mode

January 10, 2019

So I thought that I’d share our savings journey by documenting here where we start and how we achieved our 30k goals last time 🙂

A lot of where we started had little to do with the physical dollar and more with changing our mindset! But then of course comes the money side of things, which I know for some people can be super daunting.

But trust me, once you get your head around things, and also start to see what’s truly important to you and why it all becomes a lot easier! Some might even say fun!

Don’t Be Afraid Of Money/Talking About Money/Being Across Your Finances

I have found that this has been the truth for a lot of people, especially women. Thinking that someone else will take care of the money, or feeling like if they don’t know, the problems are not there!

I know that money can be a huge stress inducer for people because I’ve been there! Heck, I am there – I get it! But it’s so important to be aware of your financial situation, to understand your income sources and where your money goes!

Both of us have access to our accounts, are across what goes in and what goes out and we talk about money with each other to understand where we are at and where we want to be!

Whether you are an individual or a couple, be across your money!! Whether you are working or not, you NEED to be aware of what’s going on!

Set Your Goals & Work Out Why?

I think it’s super important to have some goals in place to motivate you to work towards.

Big picture for us, it was the stages in our renovations. We didn’t want to be taking out loans if we could avoid it and paying interest to the banks. It can be super easy to have a goal and find ways to get it straight away, but a little bit of hard work and we still reached that goal, debt free!

Check out our FREE goal setting printable to get started.

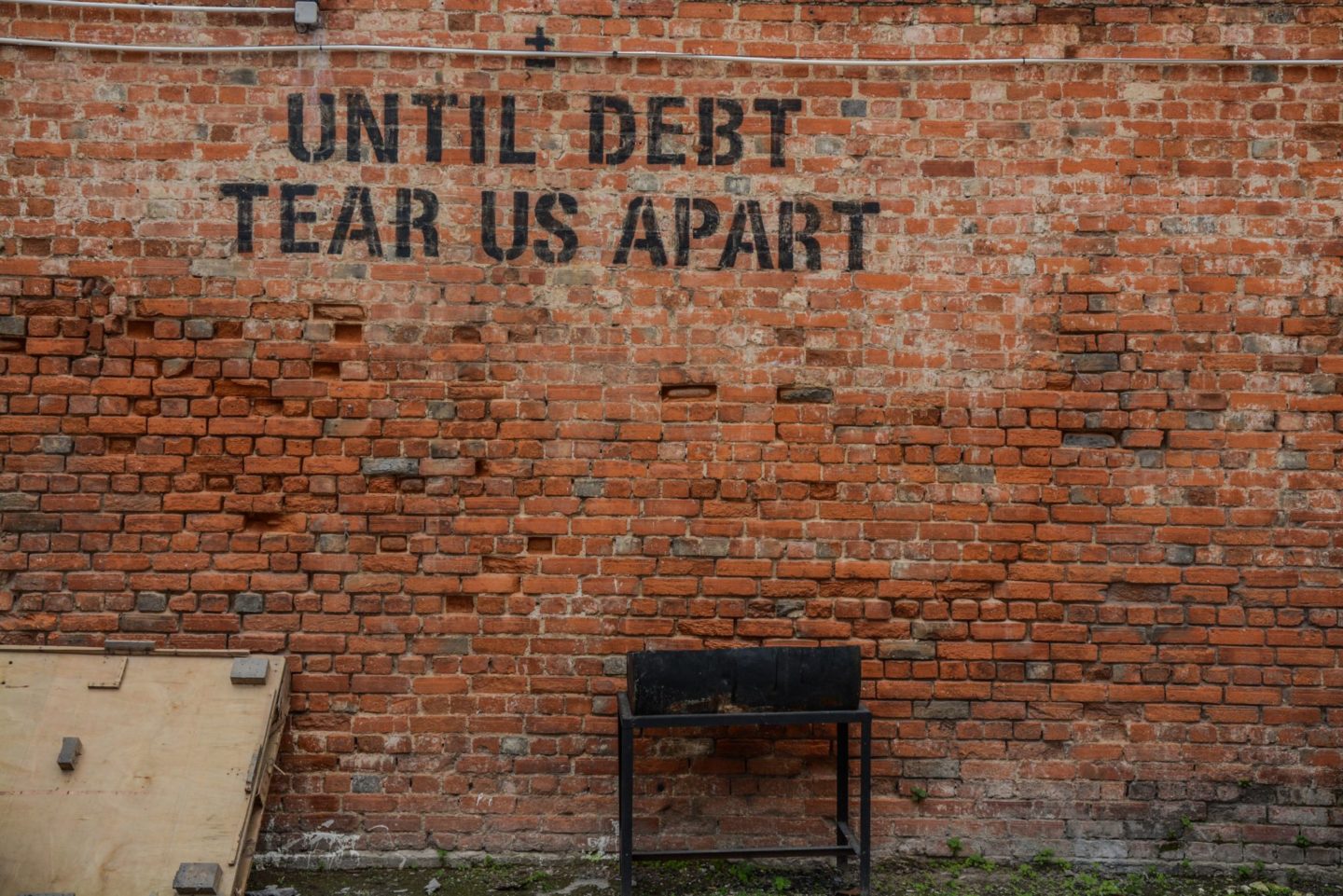

Getting Out Of Debt

You really can’t start saving any money, until you rid yourself of all unnecessary debt, especially that which has high interest!

Personally, I don’t have much experience as I’ve never had short term loans or credit card debt. But, I once had a car loan and quickly learnt what ‘compounding interest’ was.

I sold the car, paid the loan off and bought a car I could afford outright (it was a lot older and shitty, but it ran). I’ve never had a loan other than a home loan since!

To start, I would work out what you owe and where to calculate the interest on these payments and start getting them paid INSTANTLY!! If you have to go without, then do it.

If you can sell the items, like a car and trade for something more affordable, then do it!

Be Happy With What You Have While Working For What You Want

This was one of the main things my mum drilled into me as a kid! It’s great to have goals and aspirations, but you need to be content with what you have now, and enjoy it! Otherwise, you will always be lusting after something and never enjoying what you currently have!

So what’s the point if you finally reach your goal, only to create another one and never sit at the moment and appreciate it!

If It Ain’t Broke, Don’t Fix It

Can thank my granddad for this one! And it’s so true. I have many things in my life that could do with an upgrade! My car is one of them. But it runs, it gets me from A to B, and I don’t owe money on it – so why do I need a new one?

Same goes for my dining table. It doesn’t match the house at all, the kids have put food in between the top and base and it’s not looking great, but it functions exactly how a new table would? I mean it’s a table?!

Sometimes, it’s best to just leave things. Otherwise, you can spend your entire life just upgrading and buying the new thing and you’ll never save a thing!

Realise It’s a Slow Burn

Who here knows the feeling when you see something and you just want it NOW?! We all do right? Well sadly, that’s not gonna help you reach your savings goals. Just put more money in the bank’s pocket most likely…

About a year ago I decided I wanted a new lens for my camera. Again I could have put it on a credit card, taken our short term finance, sourced a cheaper version (not as good) or overextended myself – but I waited for over 6 months to buy it when I had the money.

I even waited till a sale came on for the exact one I wanted. I feel like waiting for it meant I really knew it’s what I wanted because I was prepared to wait and my mind never changed!

Same goes for big long-term goals. Sure you most likely won’t save the worth of an entire house, but saving the most you can for a deposit could save you 10’s of thousands on interest, mortgage insurance, etc.

Slow and steady wins the race!

Live Your Life

I know a big part of changing your mindset and being frugal with money is cutting down on things, but on the flip side, I also think you still need to live and enjoy your life.

If something REALLY brings you joy or is a non-negotiable, then don’t feel you HAVE to cut it. Like I mentioned before you have to be happy with what you’ve got while working toward what you want.

Balance is the word, right? We still go out on weekends, a dinner date, the movies and holidays! We just find better and more affordable ways to do it!

Do Not Compare Yourself To Others

Probably the biggest point I want to make! And for people to take home.

Social media especially has everyone comparing their lives and thinking they need bigger and better! But who does this really impact?

Don’t go making decisions, especially financial ones, because you’re worried about how you look and that you have to impress other people!

top reads

top reads

getting chatty with it

Olivia has been a keynote speaker and panellist at several national and international conferences and events over the years. Find out more about speaking opportunities with Liv.

Inspiring and motivating us to live unapologetically and confidently ourselves.

speaking

get on the list and stay in the know!

Be in the know, hear about latest products, get access to discount codes and latest from the blog.